Purchase Receipt

Introduction

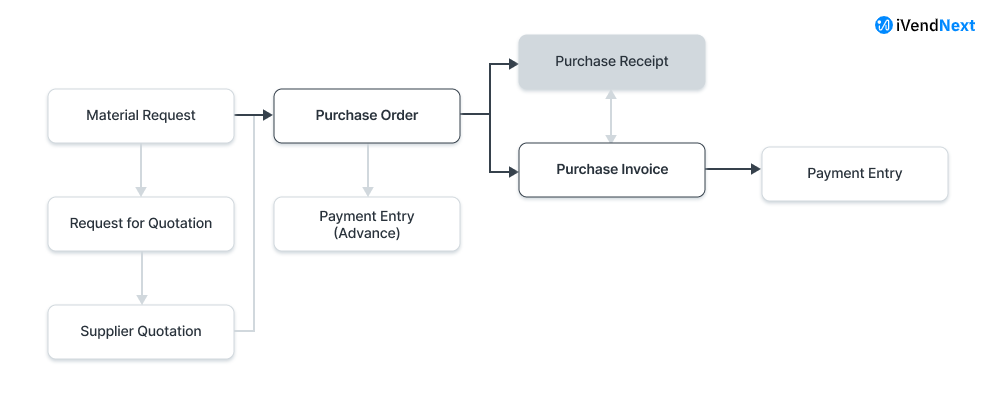

Purchase Receipts are made when you accept Items from your Supplier usually against a Purchase Order.

You can also accept Purchase Receipts directly without the need for a Purchase Order. To do this, set Purchase Order Required as “No” in Buying Settings. See: Buying Settings

To access the Purchase Receipt list, go to: Home > Stock.

Then under the Stock Transactions Section click on the Purchase Receipt shortcut. That should take you to the Purchase Receipt List View Screen.

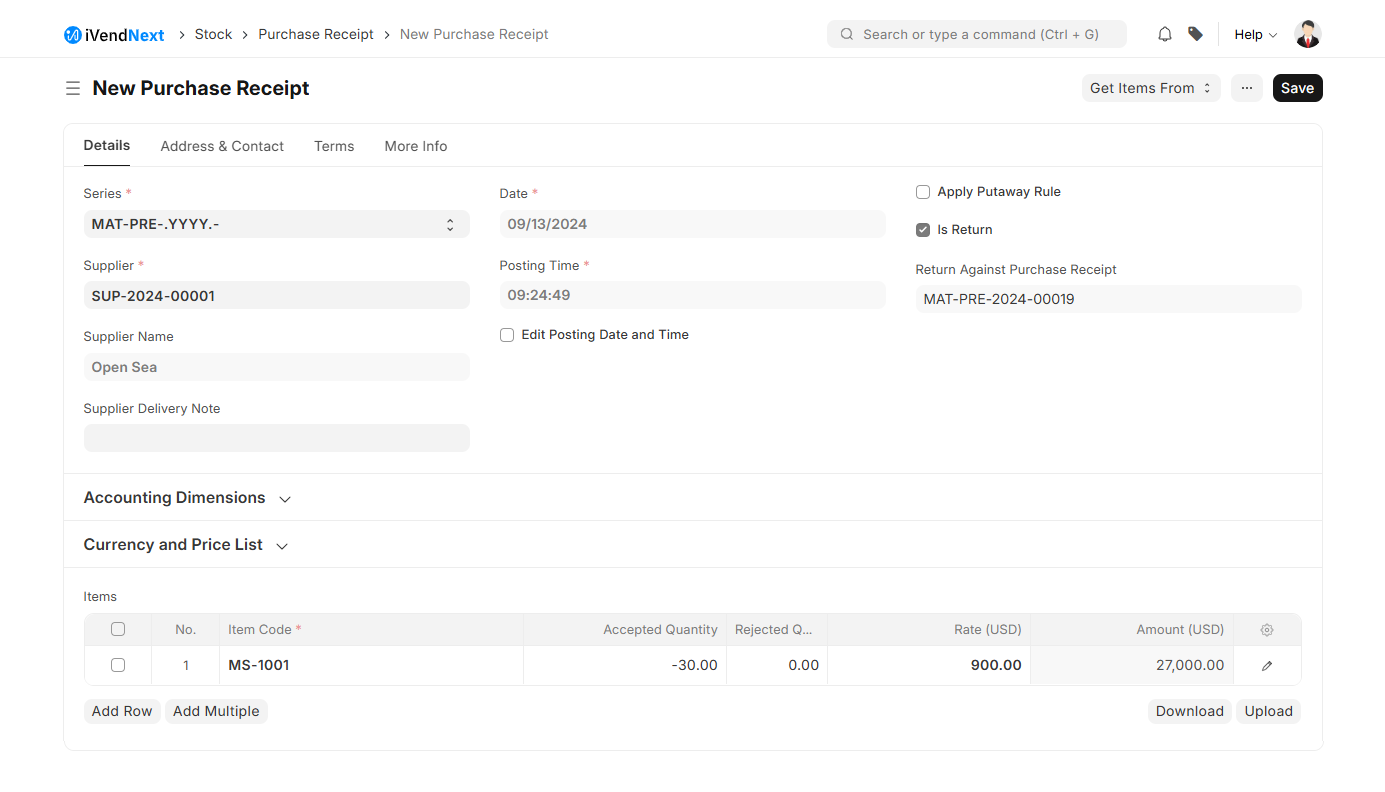

Click on the Add Purchase Receipt button. That should take you to the New Purchase Receipt Creation screen. The New Purchase Receipt Creation screen is split into the following tabs:

Details

Address and Contact

Terms

More Info

A screenshot of the Details Tab is pasted below:

A screenshot of the Address and Contact Tab is pasted below:

A screenshot of the Terms Tab is pasted below:

A screenshot of the More Info Tab is pasted below:

Fill in the required information including the mandatory fields and then click the Save button to create a Purchase Receipt.

Prerequisites

Before creating and using a Purchase Receipt, it is advised that you create the following first: Purchase Order

Steps to create a Purchase Receipt

A Purchase Receipt is usually created from a Purchase Order. To create a Purchase Receipt manually (not recommended), follow these steps:

Navigate to: Home > Stock. Under the Stock Transactions section click on the Purchase Receipt shortcut. This will open the Purchase Receipt List View screen.

Click on the Add Purchase Receipt button. This will take you to the New Purchase Receipt screen. Fill in the required information including the mandatory fields on the New Purchase Receipt screen.

The New Purchase Receipt Creation screen is split into the following tabs:

Details

Address and Contact

Terms

More Info

Select a prefix for the Purchase Receipt. iVendNext allows you to give prefixes to your Masters and transactions with each prefix forming its own series. For example, a series with prefix INV12#### will have numbers INV120001, INV120002, and so on.

Select the Supplier’s name from the drop down list.

You can fetch the Item details from the Purchase Order by clicking on the 'Get Items From’ button displayed on the New Purchase Receipt Master screen header.

You can set the Accepted Warehouse for all items in this Purchase Receipt. This is fetched if set in Purchase Order.

Set the Rejected Warehouse in case some Items are defective. The Rejected Warehouse will store the defective items.

Select the Item and enter the quantity in the Items table. The rate will be fetched and the amount will be calculated automatically.

Once you have filled in the required information including the mandatory fields on the new Purchase Receipt screen click the Save and Submit button, to save the data and exit the screen.

Statuses

These are the statuses a Purchase Receipt can be in:

Draft

A draft is saved but yet to be submitted to the system.

To Bill

Yet to be billed using a Purchase Invoice.

Completed

Submitted and received all the Items.

Return Issued

All the Items have been returned.

Cancelled

Cancelled the Purchase Receipt.

Closed

The purpose of the Close is to manage short-closing. For example, you ordered 20 qty, but closed at 15 qty. The remaining 5 is not to be received or billed.

New Purchase Receipt Screen Explained

The New Purchase Receipt screen is split into the following sections. Each section contains information specific to the section it corresponds to.

Details Section

Address and Contact Section

Terms Section

More Info Section

The Details Section

This section of the New Purchase Receipt screen includes basic information about the Purchase Receipt. For example, Purchase Receipt Posting Date, Purchase Receipt Document Series, etc. The various fields in the Details section are explained below:

Series

Select a prefix for the Purchase Receipt. iVendNext allows you to give prefixes to your Masters and transactions with each prefix forming its own series. For example, a series with prefix INV12#### will have numbers INV120001, INV120002, and so on.

Supplier

Select the Supplier from the drop down list or choose to create a new Supplier by clicking on the Create a new Supplier option. A Supplier can either be a person or a business that supplies goods or services and serves a unique role in the supply chain. If a default supplier is set, this supplier will be selected for new purchase transactions.

Supplier Name

The value in this field is fetched automatically based on the Supplier selected in the previous field.

Supplier Delivery Note

You can also add a 'Supplier Delivery Note' to the Purchase Receipt if your Supplier has added some notes.

Date

Select the Purchase Receipt Date from the calendar pop up screen. This field is mandatory. By default the application picks up the current system date. This field becomes editable only when the "Edit Posting Date and Time" checkbox is checked. This field is mandatory.

Posting Time

Specify the Posting Time. This field becomes editable only when the "Edit Posting Date and Time" checkbox is checked. This field is mandatory.

Edit Posting Date and Time

Check this box if you want to allow the user to be able to manually edit the Date and Posting Time fields.

Apply Putaway Rule

Check this box if you want to apply the putaway rule. Putaway is a rule-based system of moving items from a received shipment to the right places in warehouses based on their storage condition requirements. This helps easy access to items and organised inventory.

Is Return

Check this box if you're returning Items that were not accepted to your Warehouse

Cost Centre

Select a Cost Center from the drop down list or choose to create a new Cost Center by clicking on the Create a new Cost Center option. In iVendNext, cost centres are crucial for budgeting and financial management. They represent distinct areas or departments within a company where costs are incurred and tracked. By associating expenses with specific cost centres, iVendNext provides a granular view of spending patterns and helps in analysing budget performance.

Project

Select a Project. A Project is a planned piece of work that is designed to find information about something, to produce something new, or to improve something.

Currency

Select a Currency from the drop down list or choose to create a new Currency by clicking on the Create a new Currency option. The value in this field is automatically fetched from the Purchase Order.

Price List

Select a Price List from the drop down list or choose to create a new Price List by clicking on the Create a new Price List option. A Price List is a collection of Item Prices either Selling, Buying, or both. Price Lists can be used in scenarios where an Item can have multiple prices based on customer, currency, region, shipping cost, etc, which can be stored as different rate plans. The value in this field is automatically fetched from the Price List.

Ignore Pricing Rule

Check this box if you want to ignore the Pricing Rule. This implies that the Price List that you have specified in the Accounts under Pricing Rule will no longer hold good. Since the incoming item affects the value of your inventory, it is important to convert it into your base currency if you have ordered in another currency. You will need to update the Currency Conversion Rate if applicable.

Scan Barcode

This field displays the scanned barcode information. The value in this field is populated with the item barcode, when you scan the item using a barcode scanner. You can add EAN and UPC Barcodes for the Items. This will help you to quickly scan and add the items in the Items table by scanning their barcodes if you have a barcode scanner. Read documentation for tracking items using barcode to know more.

Accepted Warehouse

Select the Accepted Warehouse from the drop down list or choose to create a new Accepted Warehouse by clicking on the create a new Warehouse option. This field is optional. This is the Warehouse in which you'll accept and store the incoming Items. Usually, this is the 'Stores' Warehouse.

Rejected Warehouse

Select the Rejected Warehouse from the drop down list or choose to create a new Rejected Warehouse by clicking on the create a new Warehouse option. This field is optional. This is the Warehouse in which you'll keep the rejected Items which were either defective or not up to the quality mark.

Is Subcontracted

Check this box if you are subcontracting. In subcontracting, you employ an external party to carry out tasks for your organization, especially manufacturing. You can link a BOM here if the Item is being subcontracted. Linking the BOM here will affect the Stock ledger, i.e. the raw material stock will be deducted from the Supplier Warehouse. Note: The Item has to be serialized or batched for these features to work. If the Item is serialized a popup will appear where you can enter the Serial Numbers. See: Subcontracting

Item Code

Select the Item code from the drop down list or choose to create a new item by clicking on the create a new Item option.

Item Name

The value in this field will auto populate based on the Item Code selected.

Description

The value in this field will auto populate based on the Item Code selected.

Image

Displays the item image based on the Item Code selected.

Accepted Quantity

Set the Accepted Quantity. The UoM is fetched from the Item master. You will need to update the “UOM Conversion Factor” if your Purchase Order for an Item is in a different Unit of Measure (UOM) than what you stock (Stock UOM).

Rejected Quantity

Set the Rejected Quantity. The UoM is fetched from the Item master. You will need to update the “UOM Conversion Factor” if your Purchase Order for an Item is in a different Unit of Measure (UOM) than what you stock (Stock UOM).

UOM

The value in this field is automatically fetched from the Item Master. A UoM is a unit using which an Item is measured.

Rate (USD)

The Rate is fetched if set in the Price List and the total Amount is calculated.

Amount

The value in this field is automatically fetched based on the Rate (USD).

Is Free Item

Check this box if Item is offered as a free item in addition to the actual retail item. This is often seen in promotions where the item is discounted down to 0 and becomes free.

Item Tax Template

Select a Item Tax Template from the drop down list or choose to create a new Item Tax Template by clicking on the Create a new Tax Template option. Item Tax Template is useful for item wise taxation. If some of your Items have tax rates different from the standard tax rate assigned in the Taxes and Charges table, then you can create an Item Tax Template and assign it to an Item or Item Group. The rate assigned in the Item Tax Template will get preference over the standard tax rate assigned in the Taxes and Charges table. See: Item Tax Template

Landed Cost Voucher Amount

The value in this field is automatically fetched based on the Item Tax Template.

Rate Difference with Purchase Invoice

The value in this field is automatically fetched based on the Item Tax Template.

Billed Amt

The value in this field is automatically fetched based on the Item Tax Template.

Allow Zero Valuation Rate

Check this box if you want the value of stock items to always be zero, irrespective of the cost incurred. Ticking on 'Allow Zero Valuation Rate' will allow submitting the Purchase Receipt even if the Valuation Rate of the Item is 0. This can be a sample item or due to a mutual understanding with your Supplier.

Serial and Batch Bundle

Select the Serial and Batch Bundle from the drop down list or choose to create a new Serial and Batch Bundle by clicking on the create a new Serial and Batch Bundle option. You must create separate "Serial and Batch Bundles" for each stock transaction. The same "Serial and Batch Bundle" cannot be used across multiple stock transactions.See: Serial and Batch Bundle

Rejected Serial and Batch Bundle

Select the Rejected Serial and Batch Bundle from the drop down list or choose to create a new Rejected Serial and Batch Bundle by clicking on the create a new Serial and Batch Bundle option. You must create separate "Serial and Batch Bundles" for each stock transaction. The same "Serial and Batch Bundle" cannot be used across multiple stock transactions.See: Serial and Batch Bundle

Total Tax

The value in this field is automatically fetched based on the Item Tax Template.

Serial Expiry Date

Specify the Serial Expiry date from the calendar pop up screen.

Use Serial No / Batch Fields

Check this box to make visible the Serial No and Batch No fields.

Serial No

Use this field to specify the Serial No. This field is visible only when the ‘Use Serial No / Batch Fields’ checkbox is ticked. If your Item is serialized or batched, you will have to enter Serial Number and Batch in the Items table. You are allowed to enter multiple Serial Numbers in one row (each on a separate line) and you must enter the same number of Serial Numbers as the quantity.

Batch No

Use this field to specify the Batch Number. This field is visible only when the ‘Use Serial No / Batch Fields’ checkbox is ticked.If your Item is serialized or batched, you will have to enter Serial Number and Batch in the Items table. You are allowed to enter multiple Serial Numbers in one row (each on a separate line) and you must enter the same number of Serial Numbers as the quantity.

Rejected Serial No

Use this field to specify the Serial No of items rejected. This field is visible only when the ‘Use Serial No / Batch Fields’ checkbox is ticked. If your Item is serialized or batched, you will have to enter Serial Number and Batch in the Items table. You are allowed to enter multiple Serial Numbers in one row (each on a separate line) and you must enter the same number of Serial Numbers as the quantity.

Weight Per Unit

Specify the Weight Per Unit of the item. It is referred to as the physical quantity representing the weight per unit volume of a material. The value in this field is fetched automatically if set in the Item Master.

Weight UOM

Specify the Weight UOM of the item. Typical examples of Weight UOM are: kilograms (kg), pounds (lb), or ounces (oz). This is common for food / consumable items like pulses, cereals, flour etc. The Weight UoM which you use internally can be different from the purchase UoM. The value in this field is fetched automatically if set in the Item Master.

Total Weight

Displays the Total Weight. The value in this field is fetched automatically based on the Weight Per Unit and Weight UOM fields.

Manufacturer

Select the Manufacturer from the drop down list or choose to create a new Manufacturer by clicking on the create a new Manufacturer option

Manufacturer Part Number

Specify the part number for the items obtained from the manufacturer.

Expense Account

Select the Expense Account from the drop down list or choose to create a new Expense Account by clicking on the Create a new Account option. It is the account in which the cost of the Item will be debited. The amount incurred as an expense is recorded under this account.

Provisional Expense Account

Select the Provisional Expense Account from the drop down list or choose to create a new Provisional Expense Account by clicking on the Create a new Account option. The amount incurred on sales made on a particular date is recorded under this account.

WIP Composite Asset Account

Select the Provisional Expense Account from the drop down list or choose to create a new Provisional Expense Account by clicking on the Create a new Account option. The charges incurred when creating Fixed Assets are stored in WIP accounts.

Total Quantity

The value in this field is automatically updated based on the information (Item Code and Item Name) entered in the Items Template.

Total (USD)

The value in this field is automatically updated based on the information (Item Code and Item Name) entered in the Items Template.

Cost Center

Accounting Dimensions help to tag each transaction with different Dimensions without the need for creating new Cost Centers. Dimensional accounting means tagging each transaction with appropriate dimensions like Branch, Business Unit, etc. This allows you to maintain each segment separately, thereby limiting the overall maintenance on GL accounts and your Chart of Accounts remains pure.

Cost Center and Project are treated as dimensions by default in iVendNext. On setting a field in Accounting Dimension, that field will be added in transactions reports where applicable. See: Accounting Dimensions

Project

Accounting Dimensions help to tag each transaction with different Dimensions without the need for creating new Cost Centers. Dimensional accounting means tagging each transaction with appropriate dimensions like Branch, Business Unit, etc. This allows you to maintain each segment separately, thereby limiting the overall maintenance on GL accounts and your Chart of Accounts remains pure. Cost Center and Project are treated as dimensions by default in iVendNext. On setting a field in Accounting Dimension, that field will be added in transactions reports where applicable. See: Accounting Dimensions

Tracking Quality Inspection

If for certain Items, it is mandatory to record Quality Inspections (if you have set it in your Item master), you will need to update the “Quality Inspection" field. The system will only allow you to “Submit” the Purchase Receipt if you update the “Quality Inspection”.

After enabling Inspection Criteria in the Item form for Purchase and attaching a Quality Inspection Template there, Quality Inspections can be recorded in Purchase Receipts.

To know more, visit the Quality Inspection page.

Tax Category

Select the Tax Category from the drop down list or choose to create a new Tax Category by clicking on the create a new Tax Category option. A Tax Category allows applying one or more Tax Rules to transactions based on various criteria. A Tax category can be linked to one or more Tax Rules. It can be assigned to a Customer or a Supplier, so when that Customer or Supplier is selected, the Tax Category will be fetched automatically.

Shipping Rule

Select the Shipping Rule from the drop down list or choose to create a new Shipping Rule by clicking on the create a new Shipping Rule option. A Shipping Rule helps set the cost of shipping an Item. The cost will usually increase with the distance of shipping. To know more, visit the Shipping Rule page.

Incoterm

Select the Incoterm from the drop down list or choose to create a new Incoterm by clicking on the create a new Incoterm option. They are a set of internationally recognized rules which define the responsibilities of sellers and buyers. Know more about it here.

Purchase Taxes and Charges

Select the Purchase Taxes and Charges template from the drop down list or choose to create a new Purchase Taxes and Charges template by clicking on the Create a New Taxes and Charges template option. Selecting a Purchase Taxes and Charges Template will automatically apply the taxes and charges to the PO transaction. The Taxes and Charges will be fetched from the Purchase Order. See: Purchase Taxes and Charges Template.

Taxes and Charges Added (USD)

The value in this field is fetched automatically updated based on the information specified in the Purchase Taxes and Charges Template. See: Tax Category

Taxes and Charges Deducted (USD)

The value in this field is fetched automatically updated based on the information specified in the Purchase Taxes and Charges Template. See: Tax Category

Total Taxes and Charges (USD)

The value in this field is fetched automatically updated based on the information specified in the Purchase Taxes and Charges Template. See: Tax Category

Make sure to mark all your taxes in the Taxes and Charges table correctly for an accurate valuation.

Consumed Items

The Consumed Items table under the Raw Materials Consumed section contains information pertaining to the Raw Materials consumed by the Supplier in order to receive the Finished Item.

Get Current Stock

Click the Get Current Stock button to fetch the current stock of raw materials consumed from the Supplier Warehouse.

Apply Additional Discount On

Select the Apply Additional Discount On value from the drop down list. You can either apply the discount on Grand Total or on Net Total. See: Applying Discount

Additional Discount Percentage

Specify the percentage of Discount offered. See: Applying Discount

Additional Discount Amount (USD)

The value in the field is fetched automatically based on the previous field. See: Applying Discount

Page Break

Check this box to create a page break just before this item when printing.

The Address and Contact Section

This section of the New Purchase Receipt screen includes basic information about the Supplier. For example, Supplier Address, Contact Person, etc. The various fields in the Details section are explained below:

Supplier Address

The value in this field is fetched automatically when you select a Supplier under the Details section. See: Address

Contact Person

The value in this field is fetched automatically when you select a Supplier under the Details section. See: Address

Contact

The value in this field is fetched automatically when you select a Supplier under the Details section. See: Address

Contact Email

The value in this field is fetched automatically when you select a Supplier under the Details section. See: Address

Shipping Address Template

The value in this field is fetched automatically from the Address Master. See: Address

Shipping Address

The value in this field is fetched automatically from the Address Master. See: Address

Billing Address Template

The value in this field is fetched automatically from the Address Master. See: Address

Billing Address

The value in this field is fetched automatically from the Address Master. See: Address

The Terms Section

This section of the New Purchase Receipt screen includes basic information about the Supplier. For example, Supplier Address, Contact Person, etc. The various fields in the Details section are explained below:

Terms

Select the Terms and Conditions from the drop down list or choose to create new Terms and Conditions by clicking on the Create a new Terms and Conditions option.

Terms and Conditions

Specify the details, if any pertaining to the Terms and Conditions.

The More Info Section

This section of the New Purchase Receipt screen includes additional information about the Purchase Receipt. The Settings section is further subdivided into the following sections:

Status

Printing Settings

Transporter

Additional information

Status

The various fields in the Status section are explained below:

Draft

A draft is saved but yet to be submitted to the system.

To Bill

Yet to be billed using a Purchase Invoice.

Completed

Submitted and received all the Items.

Return Issued

All the Items have been returned.

Canceled

Canceled the Purchase Receipt.

Closed

The purpose of the Close is to manage short-closing. For example, you ordered 20 qty, but closed at 15 qty. The remaining 5 is not to be received or billed.

This section also shows % Amount Billed, i.e. the percentage of amount for which Sales Invoices are created.

Printing Settings

The various fields in the Printing section are explained below:

You can print your Purchase Receipt on your company's letterhead. Know more here.

Group Same Items

Check this box to group the same items added multiple times in the items table. This can be seen when your print.

Select the Print Heading from the drop down list or choose to create a new Print Heading by clicking on the create a new Print Heading option. Print Headings are the names/titles you can give your transactions. Purchase Receipt headings can also be changed when printing the document. You can do this by selecting a Print Heading. To create new Print Headings go to: Home > Settings > Printing > Print Heading. See: Print Headings.

Transporter

The various fields in the Transporter section are explained below:

Transporter Name

Specify the Transporter’s Name. The Supplier who will transport the Item to your Customer. The transporter feature should be enabled in the Supplier master to select the Supplier here.

Vehicle Number

Specify the Transporter’s Vehicle Number. This can be used for tracking.

Vehicle Date

Select the Vehicle Date from the calendar pop up screen. By default the application picks up the current system date.

Submitting a Purchase Receipt

A Stock Ledger Entry is created for each Item adding the Item in the Warehouse by the “Accepted Quantity” If you have rejections, a Stock Ledger Entry is made for each Rejection. The “Pending Quantity” is updated in the Purchase Order.

After submitting the Purchase Receipt, the following can be created:

Returning a Purchase Order

Once you've received a Purchase Order using a Purchase Receipt, you can create a return entry in case the Item needs to be returned to the Supplier. To know more, visit the Purchase Return page.

Skipping Purchase Receipt

If you don't want to create a Purchase Receipt after a Purchase Order and directly want to create a Purchase Invoice, enable the feature for it in Buying Settings.

Changing the value of Items post Purchase Receipt

Sometimes, certain expenses that add to the total of your purchased items are known only after a while. A common example is, if you are importing the Items, you will come to know of Customs Duty, etc only when your “Clearing Agent” sends you a bill. If you want to attribute this cost to your purchased Items, you will have to use the Landed Cost Voucher. Why “Landed Cost”? Because it represents the charges that you paid when it landed in your possession.